Rebates & Subsidies

Solar systems can seem expensive, especially when you’re not aware of the available rebates and subsidies.

Considering that you do meet the criteria for the solar vic rebate, the combined minimum savings you can expect from both of these is $3400! for a 6.6KW system

Currently there is access to 2 rebate types;

the solar vic rebate ($1400) &

small scale technology certificates (STCs) (between $2000-$3400 depending on system size and zone)

You also have the option of the Solar Loan . Which can further reduce your upfront cost by $1400

This is a total of $4800 in upfront cost savings.

The solar Loan will need to be payed back monthly at $29.16 over 4 years.

Solar VIC Rebate

This rebate is specific to Victoria only. It is a state government initiative in aiding the cost of a solar system.

To be eligible for the rebate you need to meet the 5 checklist criteria.

you are the owner-occupier of an existing property or the owner of a home under construction where the system is to be installed

the combined household taxable income of all owners is less than $210,000 per year

the property is valued at under $3 million, or a home under construction that will be valued at under $3 million at the time of completion

the property address has not previously received a solar panel (PV) rebate under the Solar Homes Program

the property has not had a solar panel (PV) system installed in the last ten years

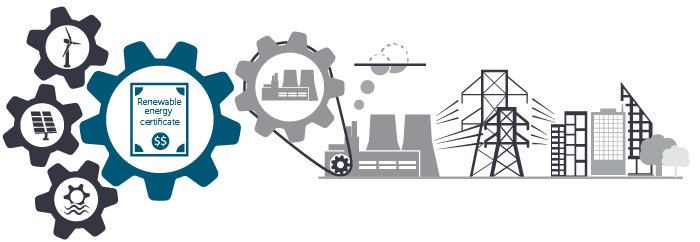

Small Scale Technology Certificates (STCS)

These certificates are generated when you purchase a solar system. They are generated based on how much your system will produce over a certain time. Once created, these certificates are then sold to other companies, helping you with the upfront cost of a solar system.

Even though customers call it a rebate it is known as a financial incentive.